As 2025 draws to an end, U.S.–China trade relations remain one of the most consequential—and complex—forces shaping global commerce. This year did not bring a full reset, but it did offer clearer signals about how the two economies intend to coexist: less illusion of decoupling, more reality of managed competition.

2025: A Year of Friction, Not Breakdown

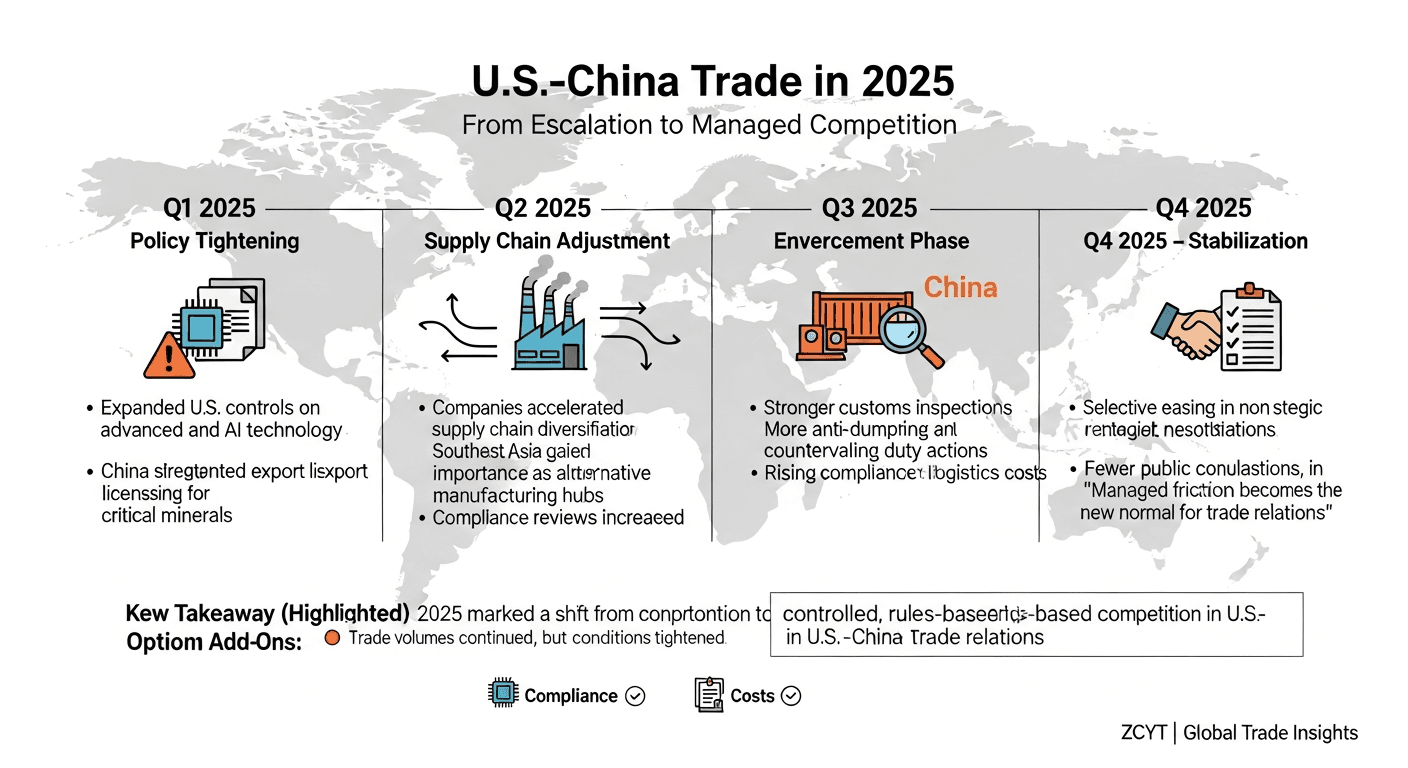

Throughout 2025, trade disputes between the United States and China continued across multiple fronts—technology, raw materials, agriculture, logistics, and compliance enforcement. Export controls on advanced chips, China’s tightening of rare earth and processing technology exports, and renewed tariff discussions all reinforced a central theme: trade has become a strategic tool, not just an economic one.

Yet despite the headline tensions, trade volumes did not collapse. Supply chains adjusted rather than disappeared. Companies rerouted, reclassified, localized, or diversified—but they did not walk away entirely.

This year made one thing clear: full decoupling is costly, impractical, and politically unsustainable.

Trade Is Becoming More Conditional

What changed most in 2025 was not the volume of trade, but the conditions attached to it.

For exporters and importers alike, compliance requirements tightened:

- More scrutiny on product origin and classification

- Greater enforcement of export controls and end-use declarations

- Increased use of trade remedies such as anti-dumping and countervailing duties

- Higher regulatory risks in “sensitive” sectors like semiconductors, energy, food, and critical minerals

Trade between the two countries is no longer “business as usual.” It is permission-based, monitored, and politically influenced.

Businesses Are Learning to Operate in the Middle

One of the defining features of 2025 was how companies adapted.

Rather than choosing sides, many firms chose structure:

- Dual supply chains

- Regionalized manufacturing

- Multiple logistics routes

- Flexible sourcing strategies

For U.S. buyers, China remains irreplaceable in many categories due to scale, cost efficiency, and industrial maturity. For Chinese exporters, the U.S. is still a critical market—but one that now requires deeper regulatory understanding and risk planning.

The lesson of 2025: resilience matters more than speed.

What 2026 May Bring

Looking ahead, the trade relationship is unlikely to dramatically improve—but it is also unlikely to spiral out of control.

Several trends are expected to continue:

- Selective easing in non-strategic sectors

- Persistent restrictions in high-tech and defense-related industries

- More negotiations conducted quietly, behind closed doors

- Greater emphasis on “rules-based competition” rather than blanket confrontation

In practical terms, this means fewer surprises—but more paperwork.

A More Mature, Less Emotional Trade Relationship

If there is one positive takeaway from 2025, it is this: both sides appear to have moved past emotional escalation and toward managed pragmatism.

Trade is no longer framed as a zero-sum game—but neither is it free. The future of U.S.–China commerce will likely be defined by guardrails, not globalization.

For businesses, the path forward is clear:

- Stay informed

- Stay compliant

- Stay flexible

Those who treat geopolitics as background noise may struggle. Those who integrate it into decision-making will remain competitive.