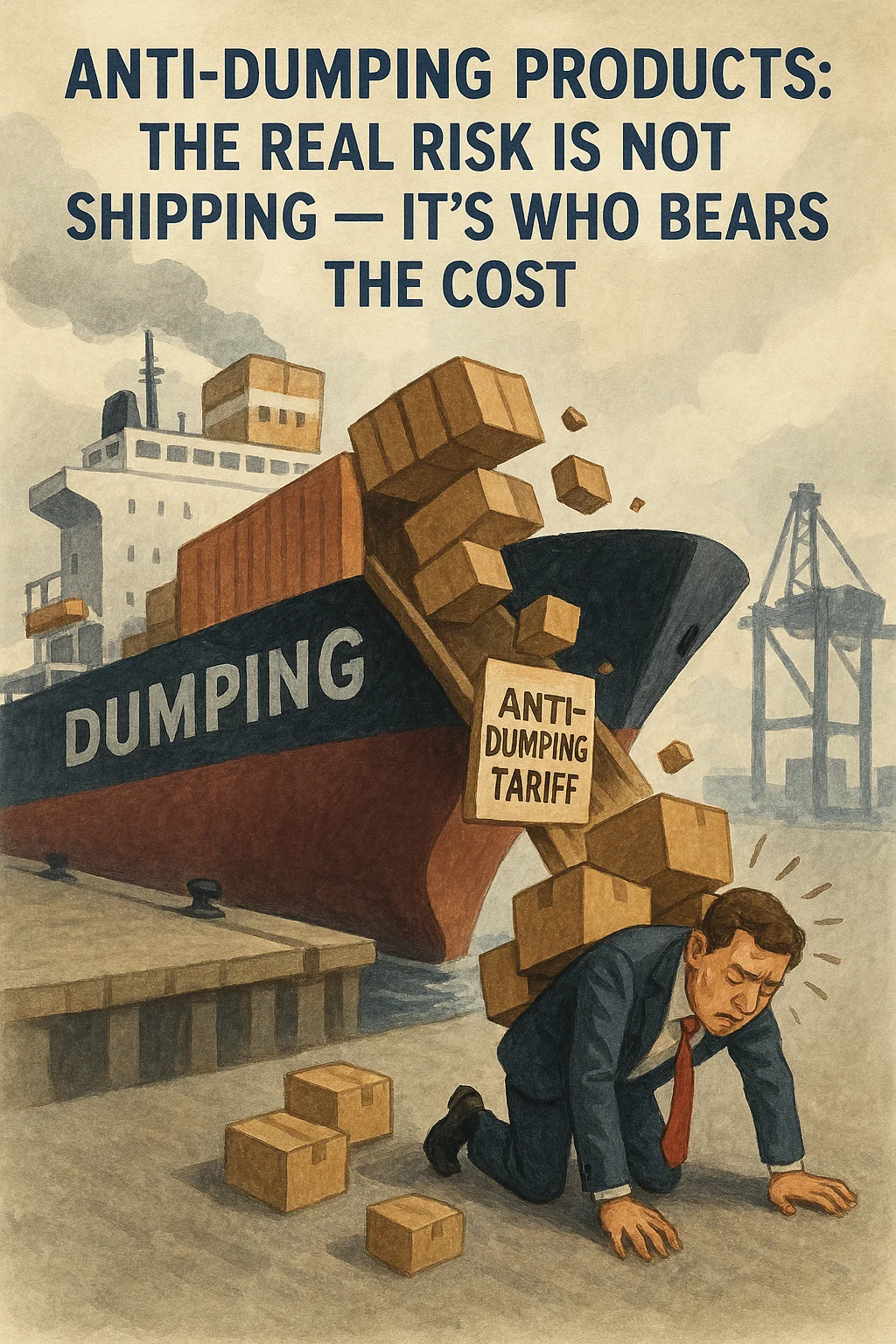

Many importers only realize the seriousness of anti-dumping risks after their cargo is already at the port.

By then, the problem is no longer whether the goods can be shipped, but who will carry the financial and compliance risk.

Products Under Constant Scrutiny

Based on recent clearance patterns, the following product categories are now effectively in a “high inspection probability” status when entering the U.S.:

- Tires

- Aluminum foil food containers

- Golf carts

- Mattresses

- Solar panels and photovoltaic products

These are not prohibited items. They ship every day.

But they are frequent targets of anti-dumping and countervailing duty enforcement.

What Happens Once Your Shipment Is Selected for Inspection?

When a container is flagged, the impact is immediate and costly:

- Daily port and demurrage costs: USD 200–300 per day

- Inspection timeline: typically 15–20 days at minimum

- Potential outcomes:

- Additional duties assessed

- Retroactive tax adjustments

- Forced return or abandonment of cargo

At this stage, delays are no longer “operational issues” — they become direct financial losses.

The Core Issue: Not Can It Ship, But Who Takes Responsibility

From a logistics perspective, anti-dumping products are not risky because they are illegal.

They are risky because the responsibility is often unclear.

Key questions every importer should ask before shipping:

- Is the declared value defensible under customs review?

- Are you prepared to pay additional duties if reassessed?

- Does your supplier understand U.S. anti-dumping compliance?

- If the cargo is held, who pays for the delay — you or the seller?

Many disputes arise not from customs, but from misaligned expectations between buyer and seller.

Why “Everything Was Fine Last Time” Is Not a Strategy

Customs enforcement is case-based, not precedent-based.

- A shipment cleared last month does not guarantee the next one will

- Inspection rates fluctuate based on enforcement focus

- Trade policy pressure often increases scrutiny without warning

Assuming smooth clearance because “it worked before” is one of the most common — and expensive — mistakes importers make.

How Experienced Importers Reduce Anti-Dumping Exposure

Professional buyers typically take the following steps:

- Conduct pre-shipment risk assessments for sensitive products

- Separate high-risk items from general cargo

- Use realistic, compliant declared values, not supplier-optimized numbers

- Work with freight forwarders who actively flag anti-dumping exposure, not just book space

The goal is not to avoid inspections entirely — that is unrealistic.

The goal is to enter the shipment knowing the worst-case scenario and being prepared for it.

Final Thought

Anti-dumping products can still be profitable.

But they are no longer “routine cargo.”

In today’s trade environment, the real question is not:

“Can this product be shipped?”

But rather:

“If customs stops it — who is ready to take responsibility?”

Understanding that distinction is what separates experienced importers from those learning the hard way.